Article ID: 2025246 Last updated: 18 April 2024

This message may occur when reconciling VAT, during a VAT submission, or viewing the VAT Obligations List.

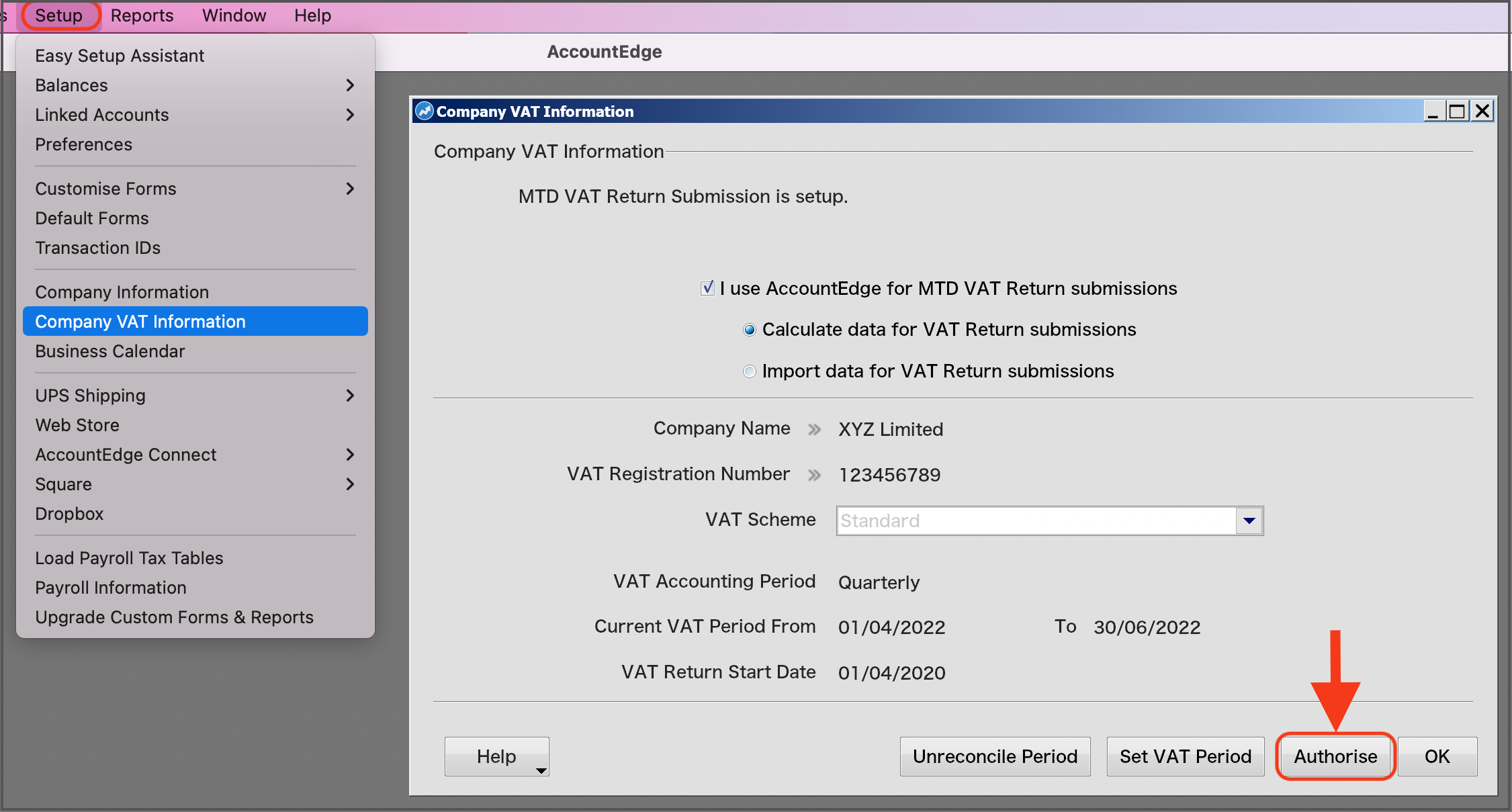

1. Go to Setup> Company VAT Information.

Click the Authorise button.

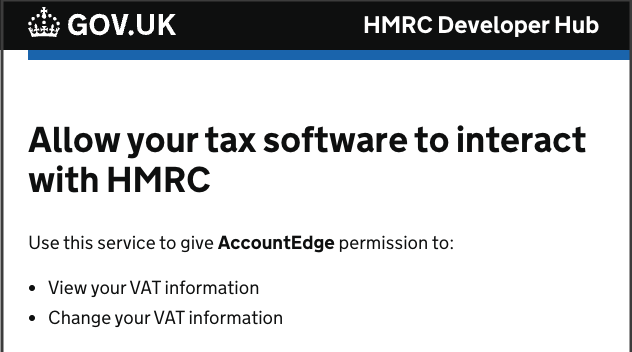

2. Your internet browser will open with the following page:

At the bottom of the window click Continue.

Sign in using your company's Government Gateway User ID and Password.

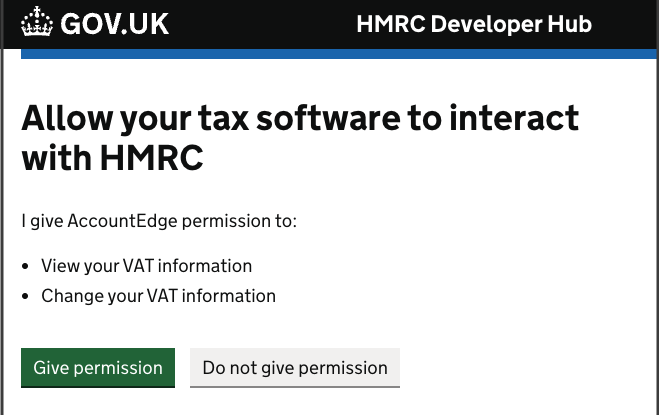

3. You will be presented with the following window:

Read the window carefully and click Give Permission.

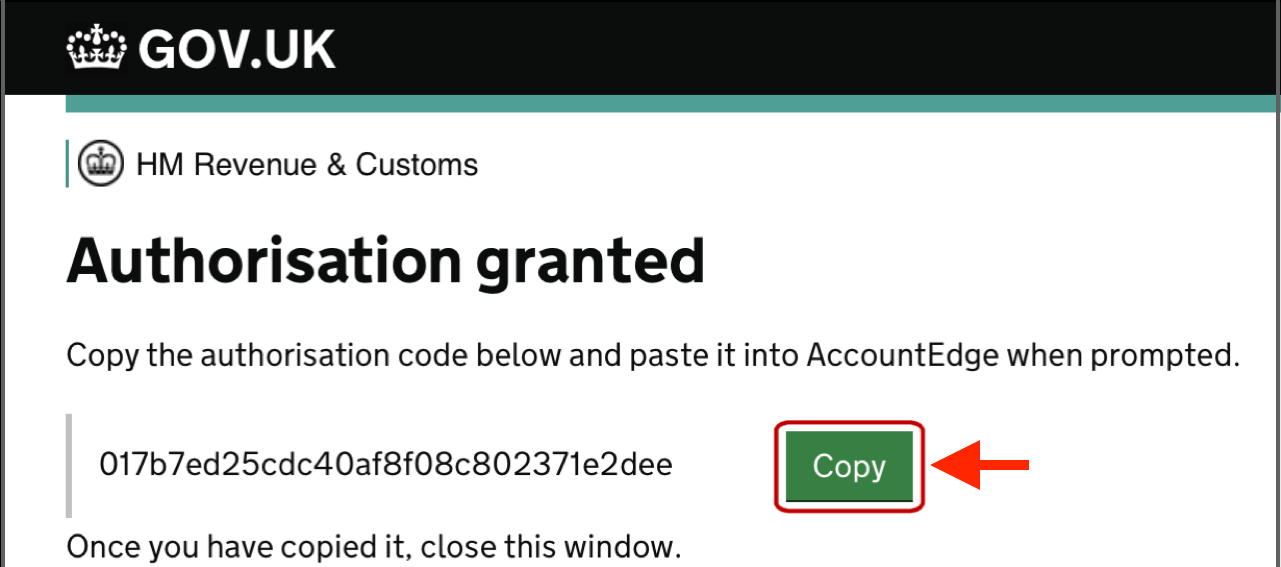

4. The Authorisation Granted window will appear:

Click Copy and close the window.

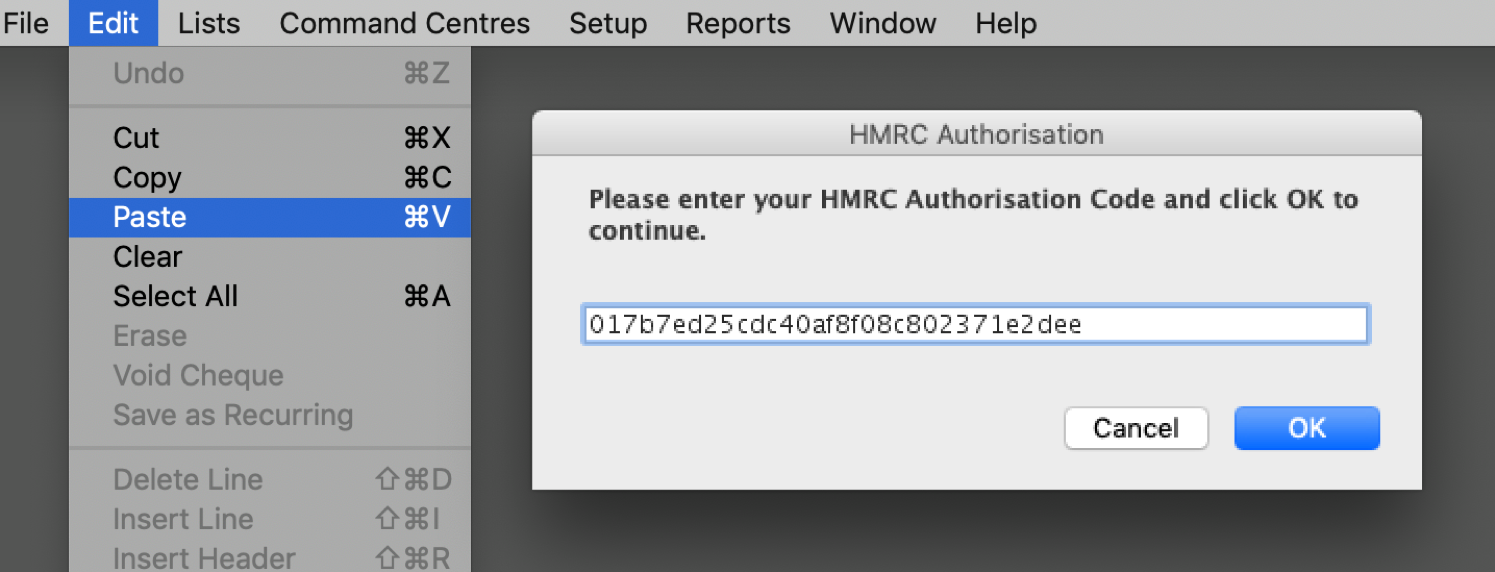

5. Return to AccountEdge where the HMRC Authorisation window will be waiting:

Click into the empty code field and then Edit> Paste.

Your HMRC Authorisation Code will appear.

Click OK.

6. The following window will appear:

Click OK.

Click the Set VAT Period button.

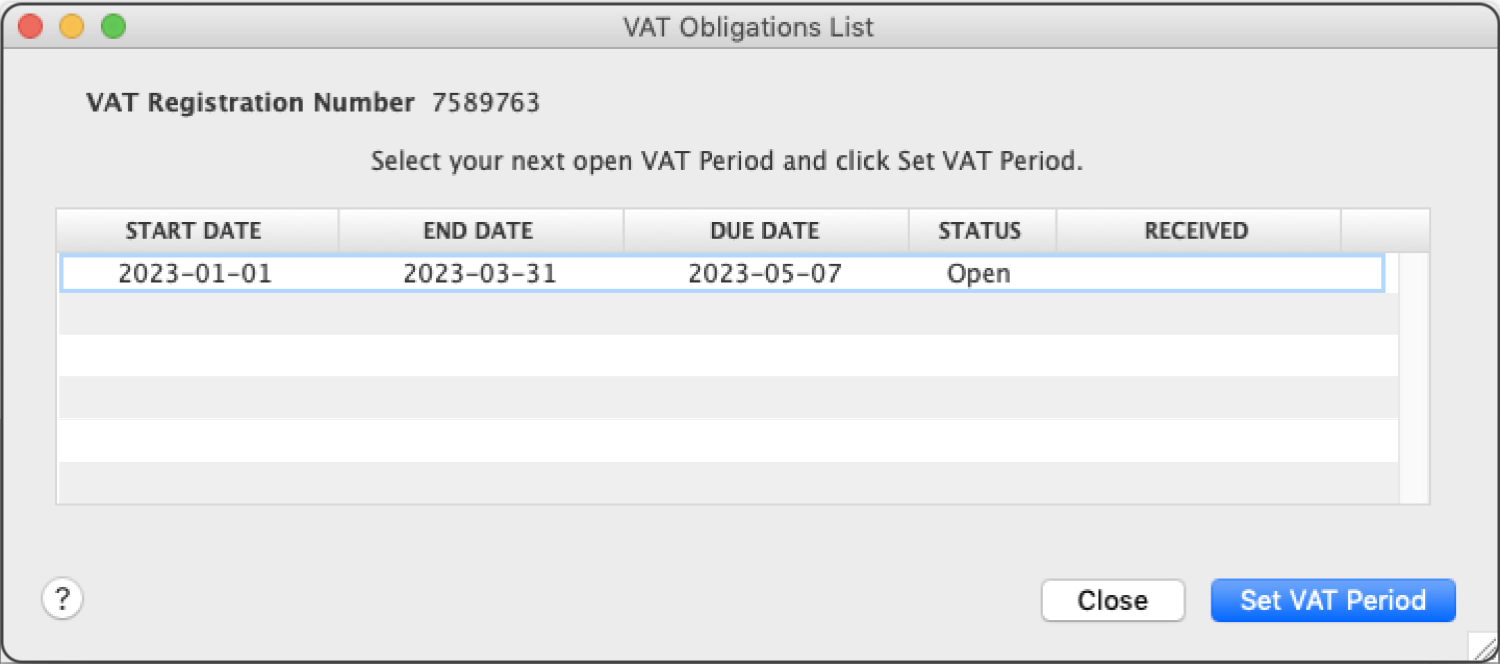

7. The VAT Obligations List will appear.

Your VAT Obligations List is retrieved directly from your company’s online gov.uk HMRC VAT account.

If the list is populated with VAT return information, then the authorisation has been successful.

Select your current open period and click Set VAT Period.