Article ID: 2025178 Last updated: 27 February 2025

If you forgot send your last pay period's FPS values to HMRC by 19 April, you will no longer be able to send these values in the conventional manner.

Instead, you will need to take the following steps:

1. Send your Final Submission year end declaration via an Employer Payment Summary (EPS) instead of a Full Payment Submission.

See Section 2.3 of the Payroll Year End Guide for details about how to send your Final Submission declaration via an EPS.

2. Once the Final Submission has been sent, go to the Full Payment Submission window and select the last 2024/25 period (the one that was not sent) and 'zoom' [»] into each employee's submission figures.

Take a note (or take screen shots) of the Year to Date values that should have been submitted for the last period, for each employee.

3. Perform all year end tasks described in the Payroll Year End Guide from Section 2.8 onwards, including Section 3, Starting the New Payroll Year.

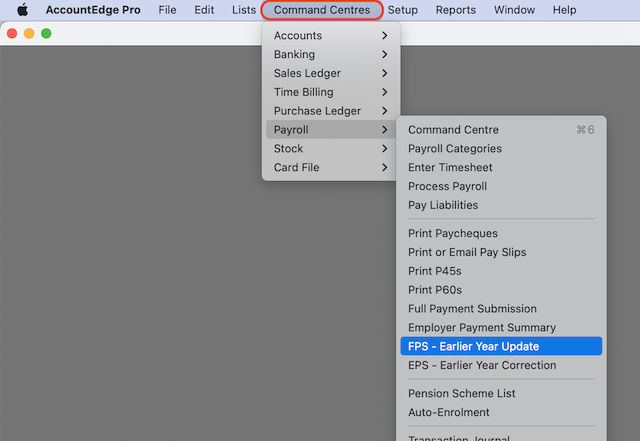

4. Once in the new 2025/26 payroll year, send your final period 2024/25 Full Payment Submission values to HMRC via an FPS - Earlier Year Update.

5. When sending the Earlier Year Update, ensure you click the white zoom [»] arrow into each employee's EYU submission figures and enter the correct YTD values you noted in Step 2, above.